What Is Drawdown In Forex

Drawdown in Forex is a cardinal metric that traders use to gage the amount of lost majuscule incurred from losing trades.

Knowledgeable traders use this information in guild to calculate how likely their trading systems are to survive over the short and long run. Therefore a comprehensive understanding of drawdowns is a key component to knowing how viable your trading setup is and tin exist.

What is Drawdown in Forex Trading?

Drawdown is a measurement of portfolio performance and how much it can blot a loss earlier the loss starts to cut into profits.

A drawdown is related to a single position where y'all enter the position and the price may go confronting you and put y'all in a relative loss before going up once more.

Information technology is also used to measure the wellness of an unabridged portfolio where yous take the winners and the losers together to make up one's mind what was the highest sequence of accumulating losses in the portfolio.

The Two Types of Drawdown

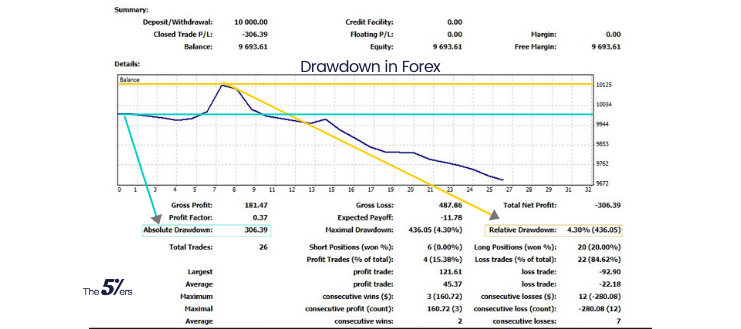

Absolute Drawdown

The absolute drawdown is the numerical difference between the first deposit and the slightest p oint under the deposit level for the duration of the test. Only put, this number tells you how big your loss can be while trading in relation to the first deposit yous made.

This metric is usually used past Investors that are not actually measuring performance , but rather those that are only concerned with bringing returns.

Relative Drawdown

The second blazon of drawdown in forex is relevant for traders who are always because his or her performance efficiency. The relative drawdown is an indicator of how much these traders can adventure as opposed to the initial investment amount. This is because the relative drawdown is the maximum driblet of Disinterestedness in per centum, not an absolute corporeality.

There are ii ways to measures relative drawdown:

1.Balance to disinterestedness:

The departure from the highest account Realized Balance to the post-obit everyman Disinterestedness (unrealized Value).

Example: if you lot begin with a $10K evaluation account, the max. drawdown is $400 which means, the lowest Equity value is $9600.

if you earn $200 after a while, the account residue will exist $10,200. At present, the lowest Equity value becomes $9800. (The drawdown functions like a abaft stop loss).

2.Equity to Disinterestedness:

This way of measuring is more strict from the other one, information technology measured the difference from the highest business relationship unrealized Value to the post-obit lowest unrealized Value (Equity ).

Example: if y'all brainstorm with a $10K evaluation account, the max. drawdown is $400 which means, the lowest Equity value is $9600.

if y'all have a floating position with a $200 profit later on a while, the account equity will be $ten,200. Now, the lowest Equity value becomes $9800. (The drawdown functions similar a abaft stop loss from disinterestedness to disinterestedness).

How to Proceed Drawdown in Forex Under Control

Five means to continue drawdown in forex under control:

- low take a chance – In fact, let'south make this a rule. Keep your run a risk below 1% of your full account. If you lose, you lot need to lose small.

- accept a intermission – If you find your business relationship heading southward with no end in sight, it'southward extremely of import that you do whatever you can to immediately begin to reduce risk. Pour over your trading strategy and plan and notice any place where adventure prevention tin can exist tightened.

- rethinking – If you can't limit risk and the losses only won't stop, walk away. You can always pull the plug and the damage will be less than if y'all tried to weather the tempest and your account got completely obliterated.

- Continuity and consistency – there is a edifice improvement, risk settle, and decreases, and your account starts to caput in a positive management.

- leverage – Adjust the leverage according to the max drawdown you lot allowed for in your trading plan. This one is pretty self-explanatory. We've outlined the pros and cons of leverage in forex trading and if you tin can properly utilize it and control it, it can help you lot abound your business relationship and succeed as a trader.

What to exercise if you lot Exceed the Maximum Drawdown?

here are two ways to react if you reach the maximum drawdown:

Stop trading and recheck your strategy

Oftentimes times, these sorts of mistakes occur when at that place is a fundamental flaw in the trading strategy. It'south not always the instance merely in the event that you exceed your maximum drawdown, the first place you lot should go is your trading strategy. At that place may be a fault that you overlooked which led to the chain of events culminating in the max drawdown.

If you do continue, cut your position size

This step is not separate from checking your strategy but rather something to do in conjunction if you decide non to stop trading while experiencing maximum drawdown. Regroup, cut your position size, reduce take chances, and go from at that place.

How Drawdown in Forex Helps You Manage Your Risk

If yous're a trader, you'll ever need to measure yourself statistically, from a relative drawdown. From whatsoever given bespeak, your strategy combined with your trading ability is capable of making that amount of possible loss. This will ascertain how risky your strategy is. This is very important to measure and work on so y'all're always enlightened of what your possible risk is.

Thanks to Drawdown, as a trader you develop subject area.

Information technology is very like shooting fish in a barrel to lose direction in trading and not exist disciplined, because of drawdown you know you have a limit, you will be a more careful and disciplined when trading forex.

Drawdown in Forex The Lesser Line

Y'all should always be enlightened of your relative drawdown while you're trading. For example, if you make 100% profit but then lose 100%, it doesn't make sense to say that you had a fifty% drawdown. It's not being honest about how you lot hazard your money.

As always, almost of this boils down to being honest with yourself and understanding your risk and knowing how to manage information technology.

Drawdown may limit you to a smaller profit, but it creates discipline and a work plan.

We wrote a like commodity idea almost The Lower Hanging Fruit – Forex Money Management Strategy.

That explains the benefits, of earning little, but consistently without leverage.

If you desire to receive an invitation to our weekly forex analysis live webinars.

Sign upwardly for ourNewsletter.

Subscribe to our youtube channel

Click here to acquire how to get qualified

Click hither to check our funding programs

Source: https://the5ers.com/drawdown-in-forex/

Posted by: candelariotrest1944.blogspot.com

0 Response to "What Is Drawdown In Forex"

Post a Comment